AI Startup From Seed to A | 매거진에 참여하세요

AI Startup From Seed to A

#VC #Invest #SeriesA #Domain #Experts #System #Design #Feedback #PMF #Scalable

From Seed to Series A: How AI Startups Are Rethinking Their VC Strategy in 2025

“In 2025, it's not the code that gets you funded—it's the flow.”

The State of the AI Investment Boom

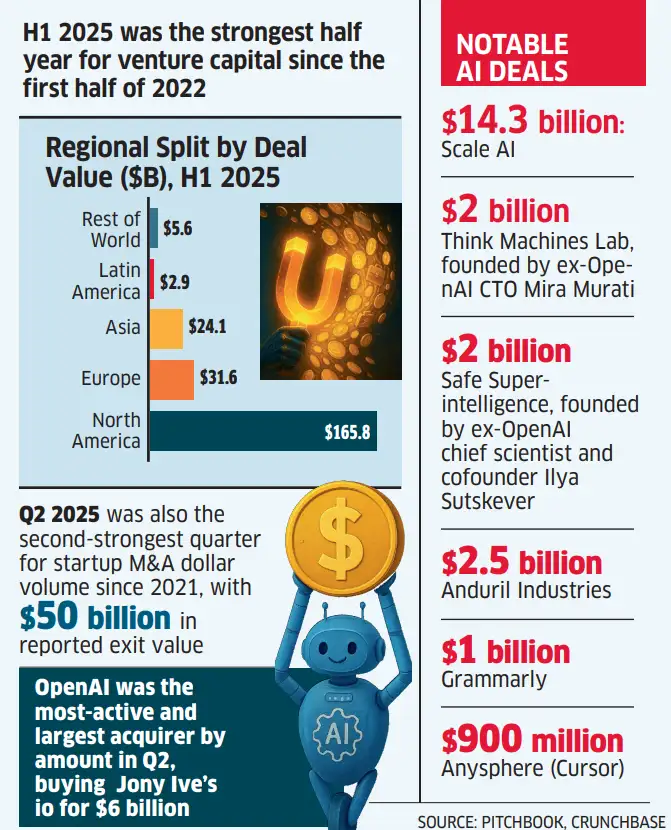

The numbers are staggering: AI startups captured 53% of global VC funding in the first half of 2025.

In the U.S., that figure jumps to 64%, with most of the capital pouring into a relatively small number of companies.

Even more telling, the average capital raised between seed and Series A has grown 128% year-over-year. It’s clear:

VCs are betting big—but only on startups that can scale fast, differentiate smart, and integrate deeply.

What VCs Are Really Evaluating at the Seed Stage

Forget "tech wizard" founders.

Top-tier investors like Andreessen Horowitz and Sequoia Capital now place greater value on what they call the “architect mindset”—founders with deep domain insight and a system-level view of user experience.

The popular concept of “vibe coding,” as coined by Andrej Karpathy, has become shorthand for founders who get the problem, design the UX, and let the model stay invisible in the backend.

“It’s not about writing the code yourself. It’s about shaping a system where AI quietly solves real user pain, without ever asking for credit.”

— Partner at Sequoia (via internal founder brief)

VCs today ask: How well have you framed the problem, and how deeply have you integrated the solution into the user’s flow?

Data Strategy: The New MVP

It’s no longer enough to “have access to data.”

VCs are now pressing for:

- Interaction-level data that’s labeled and fine-tuning ready

- Built-in feedback loops that drive product iteration

- Slides showing how data connects directly to training pipelines

Seed-stage decks need to explain not just what data exists, but how it feeds the intelligence layer in a structured, replicable way.

The Series A Checklist: What VCs Want to See

To break through pre-Series A, investors are looking for three interlocking signs:

1. Product-Market Fit Metrics

Strong LTV-to-CAC ratios

Consistent user retention and organic growth

Virality or referral-based adoption patterns

2. UX-Minded AI Integration

No more GPT wrapper apps

AI must be deeply embedded in the user flow

End-to-end task flows (e.g. “Meeting → Summary → Task Assignment”)

3. Scalability in Structure

Can the current system be replicated across verticals or teams?

Are workflows modular and extensible?

Is the AI enhancing—not interrupting—the workflow?

The Post-Series A Playbook

Once Series A is secured, investor attention shifts toward vertical scalability, agent architectures, and LLM infrastructure strategy.

Some recent examples:

- Mistral AI is reportedly negotiating a $1B+ Series B at a $10B valuation, signaling intense interest in core LLM infrastructure players.

- AgentOps is gaining traction as VCs eye executional agents capable of managing workflows autonomously.

- Public-sector AI is heating up—VCs like Sequoia and a16z are placing multimillion-dollar bets on AI solutions in law enforcement and civic infrastructure.

VC Q&A Snapshot: What They’re Really Thinking

Question | VC Insight |

|---|---|

What kind of founder stands out? | Deep domain fluency > raw coding skill |

What defines a good data strategy? | Label-rich feedback loops that fuel training |

What’s non-negotiable by Series A? | PMF signals + integrated UX + structural scalability |

Which AI sectors are most investable now? | Vertical AI, AgentOps, and public services automation |

Final Take: Winning the 2025 AI Funding Game

VCs aren’t just funding clever algorithms anymore.

They’re looking for intelligent systems that fade into the background, solving real problems in a user-centric way.

Startups must shift from flexing model performance to crafting experiences, from scraping data to structuring feedback loops, and from demoing capabilities to demonstrating workflow integration.

The stakes are higher. The capital is larger.

But the margin for noise is thinner than ever.

Build for the flow, not the flash.